Pakistan’s economy has navigated through turbulent waters to show signs of recovery in FY24. While there are positive growth indicators, substantial challenges could impact future stability.

GDP Growth and Sectoral Performance

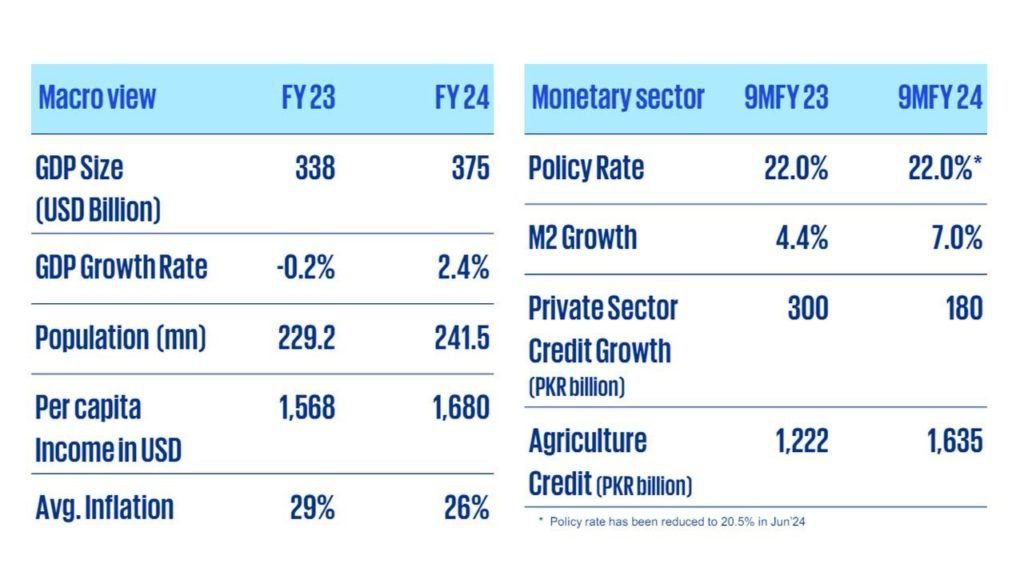

The economy expanded by 2.4% in FY24, a significant turnaround from the contraction of -0.2% in FY23. This rebound was led by an impressive 6.3% growth in the agricultural sector, up from 1.6% in the previous year. Critical crops like cotton, rice, and wheat saw robust production increases due to better input supplies and increased credit to farmers.

The industrial sector also shifted from negative growth, moving from a -3.7% contraction in FY23 to a modest 1.2% growth in FY24. The services sector, which stagnated last year, recorded an increase of 1.2%.

Inflation and Currency Stability

Inflation remained a persistent challenge, averaging 26% over the first eleven months of FY24. However, a significant drop was observed as the Consumer Price Index (CPI) fell to 11.7% year-on-year by May 2024, aided by reduced food inflation and a more stable Pakistani Rupee (PKR). The PKR appreciated slightly, with the exchange rate improving from 286 PKR/USD in June 2023 to 279 PKR/USD in June 2024.

Fiscal and External Balances

The fiscal deficit stood at PKR 3.8 trillion for the first nine months of FY24, highlighting ongoing budgetary challenges. On the positive side, the current account deficit (CAD) saw a remarkable reduction from USD 3.9 billion to USD 0.2 billion in the ten months of FY24, driven by higher exports and restricted imports.

Foreign exchange reserves increased from USD 9 billion in June 2023 to USD 14 billion by the current period, buoyed by inflows from the Naya Pakistan Certificate and assistance from international institutions like the World Bank and IMF.

Income and Debt Servicing

Per capita income rose to USD 1,680 in FY24, up from USD 1,568 in FY23, reflecting improved living standards. However, the high cost of debt servicing, which consumes approximately 56% of total revenues, continues to strain the economy.

Future Outlook and Risks

While completing a USD 3 billion Stand-By Arrangement with the IMF has provided some stability, Pakistan’s economic outlook remains cautious. Ongoing negotiations for a new three-year IMF program, expected to bring in USD 7-8 billion, are critical for addressing financing needs and stabilizing economic indicators.

Despite notable progress in various sectors, Pakistan must navigate substantial downside risks from internal and external factors to sustain this recovery. Managing high debt servicing costs, ensuring consistent foreign exchange inflows, and maintaining fiscal discipline will be crucial for continued economic stability.

In conclusion, FY24 has been a year of recovery for Pakistan’s economy, marked by significant agricultural growth and improved fiscal health. However, inflation and high debt costs pose ongoing challenges that require vigilant economic management and strategic planning.

Economic Recovery: Agriculture Leads Pakistan’s GDP Growth

Pakistan’s economy showed signs of revival in fiscal year 2024, with the Gross Domestic Product (GDP) expanding by 2.4%. This growth was primarily fueled by an impressive 6.25% increase in agricultural output, which helped counterbalance the modest 1.21% growth in both the industrial and services sectors.

The agricultural sector’s stellar performance was anchored by exceptional yields in key crops. Cotton production surged by 108.2% to 10.2 million bales, rebounding strongly from previous flood-related losses. Wheat output increased by 11.6% to 31.4 million tonnes, while rice production jumped 34.8% to 9.9 million tonnes. These gains more than offset declines in sugarcane (-0.4%) and maize (-10.4%) production, contributing to an overall 16.8% growth in major crop yields.

Despite falling short of its 3.4% target, the industrial sector’s 1.21% growth marked an improvement from the previous year’s contraction of 3.7%. This modest expansion occurred despite challenges such as reduced aggregate demand, fiscal tightening, and high interest rates. Half of the 22 industrial sectors showed positive growth, including food, apparel, leather goods, and pharmaceuticals.

The services sector matched the industrial sector’s growth rate of 1.21%. A key component of this sector, transport and communication, accounted for 20.51% of the country’s GDP and 23.0% of the services sector. The government has prioritized investments in this area to enhance Pakistan’s transportation and communication infrastructure.

This economic snapshot highlights agriculture’s crucial role in driving Pakistan’s economic recovery, while also pointing to areas for potential growth in the industrial and services sectors.

Economic Outlook: Pakistan’s Monetary Policy and Inflation Trends in FY2024

Interest Rate Developments The State Bank of Pakistan (SBP) maintained a policy rate of 22% for most of FY2024. This stringent stance was necessitated by:

- Volatile global oil prices due to Middle Eastern conflicts

- Increased gas tariffs implemented in November

However, the landscape shifted in the latter half of FY2024:

- Inflationary expectations began to decline

- Demand-supply balances improved

- Pakistani Rupee stabilized against the US Dollar

These factors led to a significant drop in the Consumer Price Index (CPI):

- May 2024: CPI fell to 11.8% year-on-year, the lowest in 30 months

- This decrease prompted the SBP to initiate monetary easing

- June 2024: Policy rate reduced by 150 basis points to 20.5%

Inflation Overview July-May FY2024 saw an average CPI of 24.5%, down from 29.16% in the same period last year.

Factors Contributing to Inflation Slowdown:

- High base effect

- Favorable global commodity prices

- Smooth food item supply chains

- Effective government administrative measures

- Impact of monetary tightening

Money Supply Dynamics Despite inflationary pressures, broad money (M2) continued to grow:

- July-March FY2024: M2 grew by 7.0% to PKR 2,216 billion

- Compared to 4.4% growth (PKR 1,212 billion) in the same period last year

This growth reflects increased money demand in the inflationary economic environment.

Fiscal Balance Remains Steady as Revenue Growth Offsets Rising Expenditures

Government Revenue Surges by PKR 2.8 Trillion in First Nine Months of FY24 The Pakistani government has made significant strides in bolstering its revenue streams, with direct and indirect tax collections rising by PKR 1.6 trillion and PKR 1.2 trillion respectively. The Federal Board of Revenue (FBR) exceeded its PKR 6.7 trillion tax collection target for the first three quarters of FY24. To further expand the tax base, the FBR is considering digital initiatives to streamline the tax system and enhance taxpayer convenience.

Non-tax revenue saw substantial gains, with the State Bank of Pakistan’s surplus profit reaching PKR 972 billion in 9MFY24, a significant increase from PKR 371 billion in the same period last year. This contribution accounted for 39% of total non-tax revenue. The petroleum levy also saw a notable rise to PKR 719 billion, up from PKR 362 billion in the previous year.

Customs tax revenue grew by approximately PKR 100 billion, benefiting from the central bank’s relaxation of import restrictions that were previously implemented to protect dwindling foreign exchange reserves.

Debt Servicing Consumes Over Half of Revenue Amid High Interest Rates Total government expenditure increased by 37%, largely due to elevated interest rates on domestic and external debt. To meet financing needs while adhering to a 40% medium-term external debt target, the government increased domestic borrowing by PKR 8 trillion between March 2023 and March 2024. With the policy rate at 22%, interest payments surged by 54%, reaching PKR 5.5 trillion in 9MFY24 compared to PKR 3.5 trillion in 9MFY23.

Defense spending rose by 22%, from PKR 1 trillion to PKR 1.2 trillion year-on-year. In contrast, development expenditure saw modest growth of 8%, increasing from PKR 1.06 trillion to PKR 1.14 trillion over the same period.

Despite these challenges, the budget deficit to GDP ratio has remained stable at 3.7%, with the deficit increasing by approximately PKR 0.83 trillion in the first nine months of FY24.